Advantage Waste Audits are risk-free and hands-free for you.

The primary service we offer to multifamily, commercial property owners, and managers is to execute a forensic analysis of current Trash Billings.

These are compared with a properties’ physical attributes, existing trash service, and service area rate tariffs to:

Determine whether or not a billing-error has been ongoing, and how much to expect from an uncovered & harvested refund. Statistically approximately 1 in every 8 accounts possesses a billing error which is corrected and for which refunds are collected.

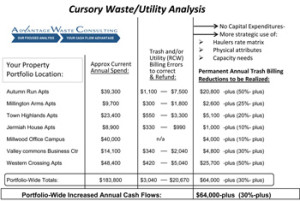

Determine how much annual trash-expense savings awaits a more strategic use of local regulatory service rate matrices as applied to the properties’ capacity needs. In a typical cross-section of 100 audited properties, there will be a permanent average annual savings for all properties of around 25%. Some will see annual reductions of 50%, others 10%- but the portfolio will realize an increase in annual cash flows of right around 25%.

Advantage Waste Audits are a risk-free service.

The resulting billing error and savings detail is a great strategic tool for determining where harvesting of hidden assets will be most productive.

At the end of the day, if we are tasked to achieve any of the results summarized in the Cursory Waste Analysis our fees are simply comprised of a one-time sharing of the actual savings (and/or refund) realized during the first year.

We look forward to an opportunity to present in more detail how our waste-cost savings process can be implemented at your specific property or portfolio of properties, and how “hands-free” the process is for you.

Sample Cursory Waste Analysis

Click image for larger view.

Common Billing Errors

- Being billed for roll-outs of dumpsters that are not on casters.

- Being billed for gate-openings where a dumpster is in an enclosure not possessing gates.

- Billings out of compliance with specific charges which are dictated by city or Utility Commission regulations.

- Billed for larger dumpster than is located in the enclosure.

- Collection frequency billed is greater than collection frequency experienced on site.

- Inaccurate recycle charges.

- Inaccurate dumpster rent charges.

- Trash bill is charging for more dumpsters than are actually at a given premises.

- Taxes & fees charged are calculated off of overcharges, so taxes have been over paid.

- Taxes charged where exemptions would nullify.